Impact of The Evergrande Debt Crisis on Indian Steel & Cement Prices

EVENT BRIEF

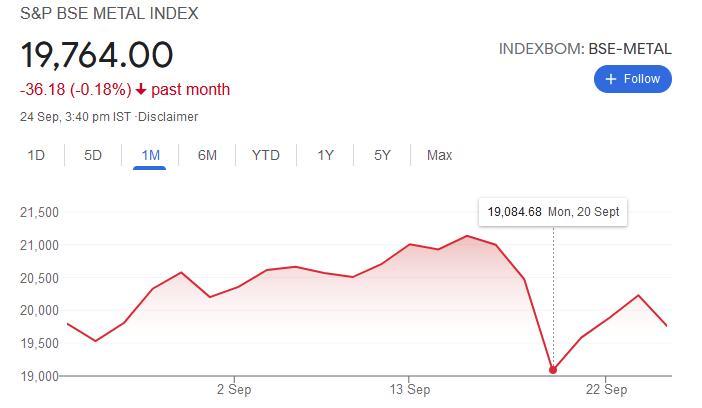

- The Evergrande debt crisis has created volatility in global markets and commodity prices, especially metals, in the second half of September. The BSE Metal Index (see below) dropped by ~7% in response to the crisis on September 20.

Source: Morningstar

Impact on Indian Steel and Cement Prices

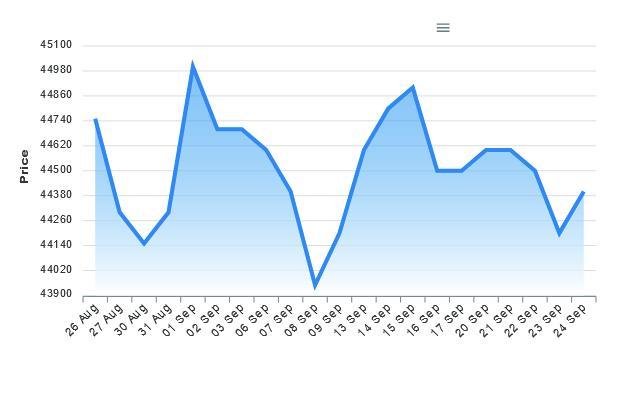

- Spot prices of long steel on the National Commodity and Derivatives Exchange (NCDEX) have not shown an extreme reaction to the Evergrande debt crisis so far (see graph below). The maximum difference between maximum and minimum spot steel prices over the past month was less than 5%. Moreover, the date of the minimum price does not correspond to the date the BSE Metal Index plunged.

Source: NCDEX (Price in INR/Tonne)

- The relative stability in Indian steel prices is attributed to robust domestic demand due to high construction activity after the second wave of COVID-19 and expectation that demand will further increase after the monsoon ends. Demand from sectors like automobiles and electronics also remained strong in the run-up to the festive season.

- Similarly, cement prices too seem to be influenced more by domestic factors. Cement has been on a downward trend since July and reports indicate this trend continued in September due to reduced demand during the monsoon season.

- Reports indicate that cement companies had tried to hike prices by ~INR 5-10/50 kg bag in early September, but were forced to roll it back. As of mid-September, the pan-India average price of cement was flat at INR 355/bag.

- There are expectations that cement prices will see a substantial increase in the coming weeks after the monsoon ends as cement companies have been absorbing high input costs (mainly pet coke) in recent months.

Evergrande Debt Crisis Primer

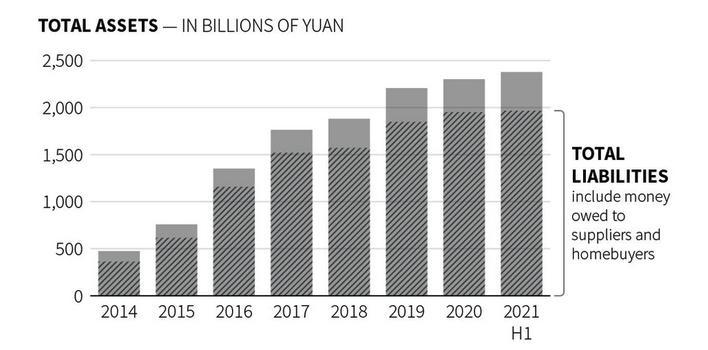

- Evergrande is China’s second largest real estate company with assets worth ~USD 309 billion and over 200 overseas and 2,000 domestic subsidiaries. Over time, it has accumulated over USD 305 billion in liabilities (see graph below).

Source: Reuters (1 USD=6.47 CNY)

- Evergrande’s shares have plunged by about 90% in 2021 amid growing concerns of its ability to remain solvent. Several key shareholders have stated their intention to offload their stake in the company.

- In early September, apprehensions over Evergrande’s ability to service its debt obligations surfaced, leading creditors in China to launch widespread protests. Evergrande needs to meet USD 669 million in interest payments by the end of the year.

- Evergrande’s liquidity crunch emerges from the Chinese government’s attempts to crack down on indiscriminate borrowing by real estate developers since 2018. Since May 2021, Chinese regulators have pushed creditors to audit bad loans of property companies, including Evergrande.

- China’s real estate sector contributes about 29% of the national GDP. However, spiralling land prices, growing debt levels and extensive speculation had put the government under pressure to slow down the property market.

Speculation Over Contagion Due to Evergrande Debt Crisis

- A key reason for markets and assets reacting on September 15 was reports that termed the Evergrande debt crisis as ‘China’s Lehman Brothers moment’ (trigger of the 2008 subprime mortgage crisis).

- The comparison was grounded in the premise that the Evergrande debt crisis had exposed deep rot in China’s real estate sector, where major companies had accumulated unreasonable amounts of debt against assets whose values may not sustain.

- Given the size of the real estate sector in China’s economy, it was speculated that a real estate sector crash would trigger a ripple effect that would affect the Chinese economy and subsequently impact global markets and commodities.

- Speculations of a contagion have since moderated. Consensus suggests that China will initiate policy measures to contain a wider fallout from the Evergrande crisis.

- However, sources suggest that the measures will be aimed at shoring up the banking sector, while maintaining pressure on the real estate sector.

ASSESSMENT

- Domestic demand factors for steel and cement appear to have resulted in prices in India failing to react to the Evergreen debt crisis. As a result, input cost pressure on Indian real estate consumers is likely to continue.

- Additionally, given that fears of a contagion due to Evergrande have moderated, the window of opportunity for major price corrections for steel and cement may have passed.

- Having said this, the situation with Evergrande continues to evolve, due to which volatility in markets and commodity prices may continue in the coming weeks. The possibility that this volatility may affect Indian steel and cement prices cannot be ruled out.

3 Comment(s)

Related Posts

No related post found.

https://Zeleniymis.Com.ua/

1 year agotri1Ls.Webflow.Io

1 year agohttps://Lvivforum.Pp.ua/

1 year ago